Revenue Pricing Model: How to Build A More Profitable Revenue Model? (infographic) 📈

Does your current pricing and revenue model incorporate the number 1 driver of value ‘risk’ to drive profitability for your business and your customers’ businesses?

>Download Now: Free PDF How to Maximise Margins with Price Trials

Do you have a high-performance pricing team capable of developing sophisticated, risk-based pricing models to create more profitable business and revenue models?

More often than not, the answer is no.

Companies just do not have the pricing capabilities or resources to identify and capture all the benefits of risk-based pricing. As a result, it takes specialist pricing skills and capability to identify, quantify and capture the full value of a changing business model.

Teams continuing to use cost-plus pricing and basic financial metrics are just not going to get the results you are looking for.

To be a price leader in your industry, you need to take your pricing and revenue models to the next way and do what trailblazers in your industry are doing right now: Build risk into your revenue pricing model.

In this article, were are going to explore comprehensive insights that businesses should grasp regarding the revenue pricing model. Initially, we will explore strategies for constructing a more lucrative revenue model. Subsequently, we will delve into case studies, comparing the advantages and disadvantages of cost-based and value-based pricing models in B2B organisations. Lastly, we will showcase a case study focusing on cruise ships, emphasising the significance of innovating a revenue pricing model.

At Taylor Wells, we believe that in order to thrive in evolving business environments, companies should elevate their pricing and revenue models. By the conclusion, you will have a clear understanding of the most suitable revenue pricing model for your business and how to enhance it as needed.

Table of Contents:

I. Revenue Pricing Model: How to Build A More Profitable Revenue Model? (infographic)

II. Pricing Model: Cost-Based Vs. Value-Based Pricing in B2B Organisations

III. Why Cruise Ship Businesses Should Rethink Their Revenue Model Strategy

Revenue Pricing Model: How to Build A More Profitable Revenue Model? (infographic) 📈

Recurring revenue model examples that challenge industry norms

- Caterpillar (equipment and product unit) for example, are now charging construction companies according to the amount of earth moved.

- Bombardier (vehicle unit) are now charging their customers for maintenance according to miles driven to lower invoice prices.

- Rolls-Royce (jet engine manufacturer) are now charging airlines a fee for every hour a plane flew.

An asset sale model examples that challenge industry norms

- MyFab (furniture retailer) have removed large amounts of production and supply chain costs from their invoice prices. Thus, they only produce and ship customers products directly from the manufacturing sites. There are no: retail outlets, inventories, complicated distribution, or logistics networks.

- Some medical technology firms are now implementing “unfulfilled volume” clauses in their contracts. In effect, discounts are now withheld if the buyer (a hospital, usually) doesn’t reach the agreed thresholds in order.

A revenue model definition fit for 2019-2020

Major advancements are happening in pricing and revenue management right now. In this article, I will discuss how pricing innovation can sometimes turn out to be more valuable and transformative than products or services. Which I’ll name and describe the e-commerce revenue model of choice in your industry. Hence, I’ll take you through the Rolls Royce case example to show you how to create a more profitable revenue model as Rolls Royce did.

I will argue that ‘value’ is found in 2 main places:

- In the risks associated with creating, supplying, and consuming your products and services

- In the process of addressing your customers’ needs and solving their problems (i.e., value creation)

The contention here is that: Wealth and value creation reside, not in the product, service or even your processes anymore, but, rather, in your value chain and the outcomes you deliver for your customers.

What is a Revenue Model?

A revenue model is a core element of your pricing architecture. Thus, it identifies what products and offers are generating profitable revenue growth and what’s not working. It also provides you with key customer and pricing insights on how your customers prefer to buy from you. Its main role is generating profitable and constant revenue streams for your business without losing too much volume in the process.

What are the components?

A well-defined revenue model includes the following elements:

- Specific pricing methods to charge customers the right (or optimal) price

- Payment terms to lock in cash at higher margins and drive customer loyalty

- Price metrics to suit customer needs (e.g., per unit versus a peruse pricing)

- Commercial breakeven models to determine the profitability of transactions

- Trackers to model risk (e.g., risk of purchasing from you and risk of not buying from you)

- Dashboards to identify, track and monitor customer buying preferences and value drivers

- Price fences to segment customers

- Price floors to cover variable costs

- Pricing ceiling to measure current willingness to pay

- Value engineering to predict future willingness to pay

- Risk modelling to track customer pain points and needs

- Dashboards to track the usual financial metrics (i.e., margin, revenue, volume, sales, discounts, elasticities etc)

Different revenue management models available to you

Over the last 10 years, many different types of revenue models have appeared on the scene. Therefore, business model changes and platform businesses have created a lot of innovation in revenue management. Now, unlike 30 years ago, you have several different options for revenue models to choose from.

Choosing the right revenue model for your business is very important: It’s your way of extracting money from your customers. You need to choose a structure that suits your business model. You also need a revenue pricing model that will make it easy for your customers to buy from you.

Remember: customers don’t spend money when they find it difficult to buy from you.

Please copy the code below to share this infographic on your website, including attribution.

<a href="https://taylorwells.com.au/wp-content/uploads/2019/08/generate-revenue-infographic.png"><img style="width:100%;" src="https://taylorwells.com.au/wp-content/uploads/2019/08/generate-revenue-infographic.png"></a><br>Infographic Provided By <a href="https://taylorwells.com.au">Taylor Wells</a>

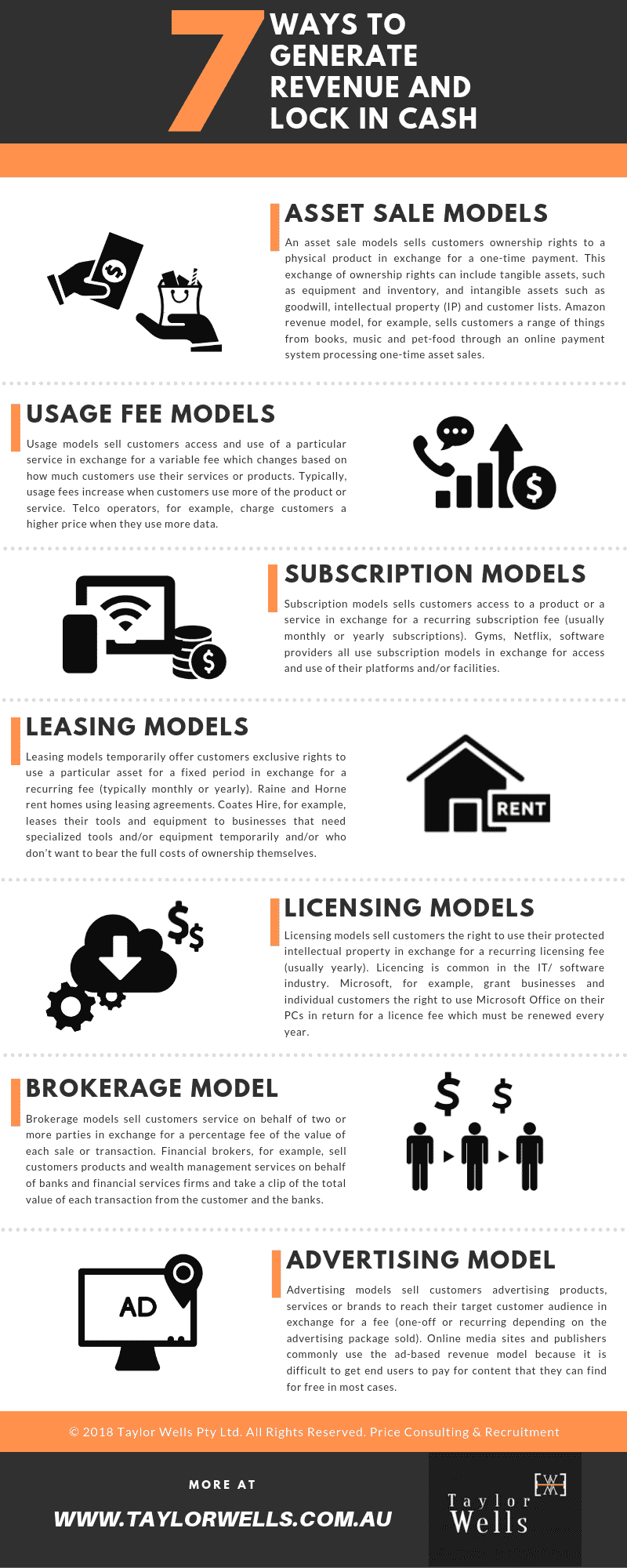

Here’s a short overview of the 7 most popular revenue models you use to generate more revenue and lock in cash. What model could you see potentially working for your business model? What model would your customers prefer?

7 types of revenue model

- Asset sale models

An asset sale model sells customers ownership rights to a physical product in exchange for a one-time payment.

- Usage fee models

Usage models sell customers access and use of a particular service in exchange for a variable fee which changes based on how much customers use their services or products.

- Subscription models

The subscription model sells customers access to a product or a service in exchange for a recurring subscription fee (usually monthly or yearly subscriptions).

- Leasing models

Leasing models temporarily offer customers exclusive rights to use a particular asset for a fixed period of time in exchange for a recurring fee (typically monthly or yearly).

- Licensing models

Leasing models sell customers rights to use their protected intellectual property in exchange for a recurring licensing fee (usually yearly).

- Brokerage model

Brokerage models sell customer services on behalf of two or more parties in exchange for a percentage fee of the value of each sale or transaction.

- Advertising model

Advertising models sell customers advertising products, services or brands to reach their target customer audience in exchange for a fee (one-off or recurring depending on the package sold).

Case study: Rolls Royce’s new pricing and revenue model

Now, to get an understanding of how all these structures and revenue management components work together, here’s a real-world example from Rolls Royce.

More than 30 years ago Rolls-Royce, a manufacturer of aircraft engines, identified some major pain points in the industry. They found:

- Airlines customers don’t like grounded planes because they lose lots of money

- Buying expensive engines was very costly for airlines

- Maintaining aeroplane engines was rife with risk

- Revenue pricing models were self-centred rather than customer-focused.

- Customers assumed all the risk

- Prices were too high

- Breakdowns and repairs were too frequent

So how did Rolls Royce deduce all of this and correct the situation? Through ongoing and detailed customer value discovery. Starting with pricing leaders doing some detailed risk modelling and price analysis of their customers’ needs…

Here’s how it all unfolded…

Rolls Royce knew they had a problem, but they weren’t sure what it was. Therefore, their customers were reporting that their engines needed quite a lot of maintenance and repair to meet international safety standards. A major complaint was inefficiency and unreliability. Customers were experiencing breakdowns due to engine problems which were grounding their planes for weeks.

The costs of downtime were just becoming too much for customers. Thus, when airlines bought a jet engine, they also had to pay large sums of money for after-care service and maintenance. Including expertise to fix the engines and any materials and parts.

The smaller airlines were the ones who were suffering the most of all: Small airlines were shorter on resources than larger carriers. What’s more, they were struggling to cover the costs of repairs and breakdowns.

Buying from Rolls Royce at this point was putting airlines at great financial risk. So, Rolls-Royce decided to change its revenue pricing model and look at how it could incorporate risk-based pricing into the model.

How did they incorporate risk? Well, they started to design a very different type of service contract that charged customers for “power by the hour.”

Unlike their old revenue model (an asset sale model selling the ownership rights of the engine), the new revenue model (‘Thrust by the hour’) enabled Rolls Royce’s customers to pay them for an engine’s flight hours. Thus, they no longer had to pay for the engine, repair time and materials. A huge saving.

The new revenue model was a hit with airlines. Hence, it leveraged risk by transferring the risk of under-utilisation back to Rolls Royce. It removed the financial risk of downtime and product failure. What’s more, their new pricing model motivated Rolls Royce to improve their performance, engines and maintenance processes because it cost too much not too change.

From here, Rolls Royce experienced a wide-scale business transformation.

How did airlines benefit from Rolls Royce new revenue pricing model?

- They only had to pay for the operating hours of the engines

- They’re no longer obliged to buy the engines.

- They’re only invoiced for the maintenance and repair of the engine based on flying hours.

- Acquired a more efficient service which greatly reduced their costs

- Better engines were acquired which massively reduce downtime

- They could fly more jets which enables them to start optimising their prices based on value too.

What did Rolls Royce get from aligning their revenue pricing model to the needs of their customers?

In short: They got constant and profitable revenue growth.

For example, in August 2019, Rolls-Royce Power Systems business recorded a 6% increase in its adjusted revenue reaching EUR 1.78 billion, while adjusted operating profit grew by 20% to EUR 109 million, in the first half of 2019.

The company’s revenue from services has also increased by 7% more than the traditional engine-related business, due to the 25% increase in the number of long-term maintenance contracts concluded and the increase in sales of replacement parts.

How can you create a pricing and revenue model that aligns with your business and market?

Create sophisticated revenue models like Rolls Royce, Caterpillar, and Bombardier. Here are some tips:

-

Analytics: Identify important customer information and data and work them into the revenue model.

-

Training: If you’re not an online business, begin to train sales and other departments to understand risk calculations.

-

Strategy: Try to incorporate a risk review in your price review process.

-

Human Capital: Start to invest in the right people.

-

Scientific hiring: Look for better ways to hire skilled pricing leaders. You now need a pricing team that can work with the business and your customers to manage and build risk into your new revenue pricing model.

〉〉〉 Get Your FREE Pricing Audit 〉〉〉

Conclusion

It’s time to rebuild your pricing team to ensure your pricing transformation generates value for you and your customers.

The risk of not having a world-class pricing team on board in 2020 has millions of dollars of cost associated with it.

Pricing Model: Cost-Based Vs. Value-Based Pricing in B2B Organisations 🍈

The right pricing strategy is crucial to the success of your business. However, which pricing model is right for you? Do you focus on the Costs of Goods Sold or your Freight costs to set final invoice prices via a cost-based model? Or do you aim to understand and focus on what your customers value about your products and services via a value-based model? Before deciding, it is essential to understand both options and how they will work for your business and impact your pricing, marketing, and go-to-market strategy.

Cost-based pricing model

B2B companies that use a cost-based pricing model tend to base their product prices on calculating the materials and time required to create them. As with all options, there are pros and cons to this approach:

Pros

-

- It is a simple method that you and your customers will understand

-

- Sales teams feel it gives them more room to negotiate invoice prices for large and new accounts

-

- It is considered to be a logical and fair approach because it is looking at tangible costs.

-

- Businesses with >1000 SKUs believe it’s easier to implement a price rise for their customers

Cons

-

- From a customer point-of-view, it does not encourage efficiency

-

- Customers who know you are using a cost-based model tend to want to know what margin you are making (and become less concerned about the value you offer)

-

- Leaves room for both under and over-pricing – massive price transparency risk. Customers switch if they feel they are being ripped off.

-

- Leaves money on the table

-

- Difficult to track – due to volatility in the market (FX, commodities price change), many businesses haven’t got an accurate read on their cost position.

-

- Most cost-based pricing models are not even accurate or fair – they are the basis of aggregate costs.

-

- Fully allocated costs, lead to overprices in a price-sensitive market.

-

- Cost-based pricing models, anchor value to your price floor as opposed to your price ceiling

Value-based pricing model

Value pricing goes beyond the cost of a good or service. Thus, it starts with value engineering to understand the market, i.e., how customers understand your offer and value your products and services by segment (see more detail on psychographic segmentation examples). Hence, we then move on to identify individual customer value drivers – why the customer is buying from you. It then measures how much customers are willing to pay for your products. In effect, it then validates willingness to pay information (usually self-rating) with price elasticity analysis by segment.

Value-based pricing models aim to go beyond a simple markup strategy for product or service pricing. Moreover, the aim is to quantify the total economic value of your offer and understand ways you can help your customers make money by working with you. See tips here on how to do a great proposal with this in mind.

Pros

-

- Higher profit for a similar level of volume compared to other pricing structures

-

- Less volume pressure with a focus on quality as opposed to a price point

-

- Customers receive more top-quality service and are willing to pay a higher price because they understand the value and realise you are either fixing a real problem for them or helping achieve their profit targets

Cons

-

- The consumer needs to understand the value of what you are selling – Not everyone will want or want to understand your offer. Which means you are appealing to a much smaller audience

-

- You will need to undertake a more sophisticated segmentation to find the customers willing to pay and who need your products and services. Broad base segmentation won’t cut it

-

- Real dedication to your customer base is required. Thus, when you find the right customers who understand and value what you offer, it’s unlikely to be a one-off sale. Therefore, you’ll need an excellent key account manager to look after and nurture the account. Hence, one who can cross-sell (not just because they have gained the customer’s trust) to prevent the customer from risk or to help them generate more profit. A true partnership

Industry leaders with an emphasis on value

Caterpillar, one of the leading corporations in industrial equipment manufacturing utilise value-based pricing to great success. Thus, their pricing and revenue management team identify the smart financial solutions that work both the business and customers’ bottom lines. Therefore, they apply this to everything they provide, from a one-dollar bolt to a multimillion-dollar machine.

The value-based requirements that Caterpillar adheres to include:

-

- Serving as a trusted guide and advisor for their clients

-

- Operating with the highest levels of integrity

-

- Building strong relationships with the people they serve

In a similar vein, GE Subsea Systems moved its pricing model toward a value-based model from a cost-based three years ago and continues to strive for success with this method.

They decided that the transition was crucial from a cultural, systems, and infrastructure perspective. In effect, they achieve this by having regular pricing reviews across various levels of the business and with a significant focus on training their staff. GE uses a developed training program (online learning modules and instructor-led).

The marketing of pricing

Both of these pricing models utilise marketing to communicate to consumers effectively. Thus, cost-based pricing takes competitors into account when competing with price. However, value-based is about personalising offers to benefit the customer (not our cost position).

Both options require you to consider your company’s market offering and how it compares with competitors. You need to find your competitors and their pricing strategies.

The future is full of value

We now see many more large corporations moving toward a value-based pricing model to maximise margins in increasingly competitive, margin-pressured industries. Moreover, the cost is a substantial profit driver to consider, but a cost-based approach to pricing is not enough to generate the margin gains the business want.

Value-based pricing is not just a fluffy jargon term. Hence, it is a practical means to develop margin expansion plans. Also, this can include mixed management, volume growth, cost reductions, discounts/rebates and price rise optimised pricing decisions. Therefore, value-based pricing is increasingly being used to develop 12-18-month price rise optimisation plans. This directly impacts how much profit value you generate for the business and your customers.

〉〉〉 Get Your FREE Pricing Audit 〉〉〉

Making the journey to value-based pricing

Considering that a cost-based pricing model is not an effective long-term pricing strategy as it ignores consumer needs, you may be looking to make the switch.

The two most significant obstacles in making the change are value engineering/discovery assessment and value communication. How do you identify the value of your product or service? Once you have, how do you communicate this value effectively to your current and potential customers? If this is something you are considering and struggling with, we can help. Get in touch with us to discover how to turn your cost-based pricing model into a value-based system today.

Click here to access your free pdf guide on driving pricing strategy in your business.

Why Cruise Ship Businesses Should Rethink Their Revenue Model Strategy ⚓️

In a quest for more effective and innovative revenue streams, cruise companies are undergoing a paradigm shift in their pricing strategies. Traditionally, last-minute deals have been a stalwart approach to filling unsold cabins, enticing budget-conscious travellers with enticing discounts. However, the evolving landscape of the cruise industry, consumer behaviour, and the need for stable and predictable revenue have prompted these companies to rethink their pricing and revenue model strategy.

Pricing in the cruise industry presents a unique and intricate challenge. It’s a balancing act, as cruise companies must consider ever-changing demand influenced by seasonal variations, destinations, economic conditions, and consumer preferences. Additionally, the need to manage an extensive range of cabin categories, onboard amenities, and special packages adds complexity. Ultimately, crafting effective pricing strategies necessitates striking a fine equilibrium between maximising revenue, ensuring high occupancy rates, and offering competitive deals to meet the diverse needs of passengers in a highly competitive marketplace.

In this article, we are going to discuss the transformation occurring within the cruise industry as companies explore new methods to optimise their revenue model strategy, moving beyond the reliance on age-old last-minute deals. Following that, we provide recommendations for cruise industry businesses to enhance their pricing strategies while adapting to the industry’s shifting trends. We argue that traditional pricing strategies solely driven by profit motives, devoid of due regard for customer value, are ultimately ineffectual.

At Taylor Wells, we believe that cruise companies should persist in innovating and modernising their pricing methodologies to ensure enduring financial success. By the end, you will grasp how cruise companies can safeguard their pricing strategies, value propositions, and business models for the future.

Cruise Ship Revenue Model And Marketing Strategy To Increase Revenue

Cruise companies have been utilising traditional pricing and revenue strategies for many years, and one such strategy in focus is the implementation of last-minute deals. This strategy offers several advantages and disadvantages when considering it as a tool for revenue and occupancy management.

On the positive side, last-minute deals can be a potent tool for optimising revenue and filling unsold cabins. For instance, imagine you have a Caribbean cruise scheduled, and as the departure date approaches, there are still some cabins unoccupied.

Offering substantial discounts on these remaining cabins can entice budget-conscious travellers, increasing occupancy rates and overall revenue. By leveraging this approach, cruise companies can effectively manage their inventory, ensuring that fewer cabins go unsold.

However, there are caveats to this strategy. One downside is that last-minute deals can be unpredictable, making it challenging for some travellers to plan their vacations well in advance. Additionally, while these discounts can fill cabins, they might erode overall revenue per passenger if not strategically implemented.

We think that depending heavily on last-minute deals as the core promotional pricing strategy for cruise companies presents several notable disadvantages.

Firstly, it introduces revenue volatility, as the company’s income becomes more unpredictable due to the last-minute nature of bookings. This can lead to significant fluctuations in earnings and hinder effective financial planning.

Secondly, while last-minute deals can help fill unsold cabins, the substantial discounts required to attract late bookings can substantially erode profit margins, potentially impacting the overall financial health of the cruise line.

Moreover, an overreliance on this strategy may affect brand perception, as passengers who booked well in advance at higher prices may perceive themselves as overpaying when last-minute deals are offered, potentially resulting in customer dissatisfaction.

Additionally, the management of inventory becomes more complex when the majority of bookings are last-minute, making it challenging to coordinate logistics, staff assignments, and the procurement of necessary supplies.

Lastly, passengers opting for last-minute deals may have limited cabin options, potentially affecting their satisfaction with the cruise experience.

Currently, a number of cruise companies are reconsidering and modernising their conventional pricing structures and revenue model strategy. As an example, Princess Cruises has decided to discontinue the practice of providing last-minute, reduced ticket prices and special offers on all their cruise journeys and accommodations in the upcoming years. Let’s explore their approach to this change.

Discussion On The New Princess Cruises Revenue Model Strategy And Price Drop Policy

Rather than last-minute deals, Princess Cruises is going to reward the early birds – i.e., people who buy cruise liner tickets and rooms months in advance – and penalise late bookers. A complete 360 on the legacy cruise pricing and revenue model strategy. This is how they are doing it:

Revenue Model Strategy #1: Dynamic Pricing

In an interesting strategic shift, Princess Cruises has reversed its dynamic pricing approach. Traditionally, cruise lines often relied on last-minute discounts to fill cabins, a tactic that sometimes eroded profit margins. However, Princess Cruises is now implementing a proactive pricing strategy by setting its dynamic pricing algorithm to offer cruise tickets at the lowest point within the price range several months ahead of departure.

This adjustment reflects a significant departure from the industry norm and is poised to reshape how passengers plan and book their voyages. This bold move by Princess Cruises seems to be an attempt to create a more predictable and stable revenue stream by discouraging last-minute bookings with steep discounts.

By transparently communicating that prices will incrementally rise as the departure date approaches, they’re providing potential passengers with the incentive to book earlier in the booking window, securing their preferred cabins and itineraries.

This shift aligns with the broader industry trend of moving away from last-minute deals and enhancing the value of advanced bookings, where passengers may be willing to pay a premium for early reservations. It’s a notable development that highlights the ever-evolving dynamics of pricing strategies in the cruise industry.

Revenue Model Strategy #2: Best Price Guarantee

Princess Cruises has taken a customer-centric approach by introducing a “best price guarantee” for their top-tier offering, ensuring that passengers who book the same cruise destination and stateroom category will receive the best available price. This initiative reflects a commitment to customer satisfaction and transparency, aiming to build trust and loyalty among their clientele.

By guaranteeing the best price within its own offerings, Princess Cruises is emphasising its dedication to providing value and ensuring that customers feel confident in their booking decisions. This customer-focused strategy not only enhances the overall cruise experience but also strengthens the company’s competitive edge in the market.

Revenue Model Strategy #3: Price Promotions

Princess Cruises’ approach to price promotions exhibits a nuanced shift in catering to last-minute travellers. By allowing passengers to secure current pricing for future vacations, even if their travel dates remain uncertain, the cruise line is striking a balance between offering flexibility and maintaining financial stability.

This strategy is particularly intriguing because it not only caters to the needs of customers who prefer spontaneous travel decisions but also provides the cruise company with a measure of financial predictability from a typically unpredictable segment of their customer base.

In the ever-competitive cruise industry, this move underscores the importance of managing customer segments effectively. By targeting and accommodating the last-minute traveller with this approach, Princess Cruises is not only enhancing its appeal to a broader range of passengers but also securing revenue streams in advance, aligning with more proactive pricing models.

Revenue Model Strategy #4: Multi-Buy Tickets

Princess Cruises is strategically tapping into the family and group travel market by introducing reduced fares for third and fourth passengers sharing a stateroom. This move enhances the affordability of cruising for these travellers and positions the cruise line to attract more family and group bookings.

The cruise industry has been increasingly recognising the potential of this market segment, as it not only promotes higher occupancy rates but also fosters a sense of togetherness and shared experiences among passengers. This initiative reflects Princess Cruises’ commitment to value-based pricing strategies that benefit both passengers and the company’s bottom line.

Implications Of Improving Pricing And Revenue Model Strategy In The Cruise Industry

Princess Cruises could be regaining market share from rival cruise lines by motivating passengers to book their Princess Cruises voyages early, or else face the prospect of higher costs or unavailability. The effectiveness of this psychological scarcity tactic remains to be seen. This shift raises questions about the future of exceptional last-minute cruise deals in the industry.

Other companies can learn from Princess Cruises the importance of embracing a proactive promotional pricing strategy that prioritises early bookings.

By dynamically pricing cruise tickets at their lowest point within the price range months in advance and encouraging passengers to secure future vacations at present pricing, Princess Cruises aims to balance flexibility for customers with the predictability of revenue. This approach caters to different customer segments and allows the cruise line to capture the value of advanced bookings, offering a valuable lesson in how to manage pricing strategies effectively.

Our findings show that with the right set-up and pricing team in place, incremental earnings gains can begin to occur in less than 12 weeks. After 6 months, the team can capture at least 1.0-3.25% more margin using better price management processes. After 9-12 months, businesses often generate between 7-11% additional margin each year as they identify more complex and previously unrealised opportunities, efficiencies, and risks.

The best pricing advice for Princess Cruises, and indeed for cruise companies in general, is to strike a delicate balance of offerings between last-minute clients and early birds. While it’s essential to create value for passengers through promotions, maintaining consistent revenue streams is equally important. By tailoring pricing strategies to align with passenger preferences and market trends, cruise companies can navigate the dynamic landscape of the industry and remain competitive while ensuring financial stability.

Our findings show that when a business builds and embeds commercial capability across the business; bolstering its internal pricing skills and capabilities to build a sustainable pricing system, it can generate at least 3-10% additional margin each year while protecting hard-earned revenue and volume. This is at least a 30-60% profit improvement straight to the bottom line.

〉〉〉 Get Your FREE Pricing Audit 〉〉〉

Bottom Line

Princess Cruises’ innovative pricing strategies showcase an industry shift away from traditional last-minute deals, emphasising the importance of early bookings and customer loyalty. This revenue model strategy underscores the value of striking a balance between flexibility and financial predictability, enabling cruise companies to secure a more stable revenue stream. As competitors adapt to these evolving dynamics, it’s clear that the cruise industry is reevaluating how pricing strategies can enhance passenger satisfaction while strengthening its bottom line.

The lessons from Princess Cruises extend to the broader market, highlighting the efficacy of proactive pricing models, transparency in pricing guarantees, and appeal to different customer segments. While the era of incredible last-minute cruise deals might be evolving, the industry is embracing new approaches to meet changing passenger needs and foster financial stability. By staying attuned to market dynamics and continually fine-tuning pricing strategies, cruise companies can navigate this evolving landscape effectively.

For a comprehensive view and marketing research on integrating a high-performing capability team in your company,

Download a complimentary whitepaper on How To Maximise Margins.

Are you a business in need of help to align your pricing strategy, people and operations to deliver an immediate impact on profit?

If so, please call (+61) 2 9000 1115.

You can also email us at team@taylorwells.com.au if you have any further questions.

Make your pricing world-class!

Related Posts

Leave a Reply Cancel reply

Categories

- marketing strategy (26)

- Organisational Design (14)

- Podcast (114)

- Pricing Capability (87)

- Pricing Career Advice (10)

- Pricing Recruitment (19)

- Pricing Strategy (287)

- Pricing Team Skills (13)

- Pricing Teams & Culture (24)

- Pricing Transformation (47)

- Revenue Model (25)

- Sales Effectiveness (27)

- Talent Management (7)

- Technical Pricing Skills (35)