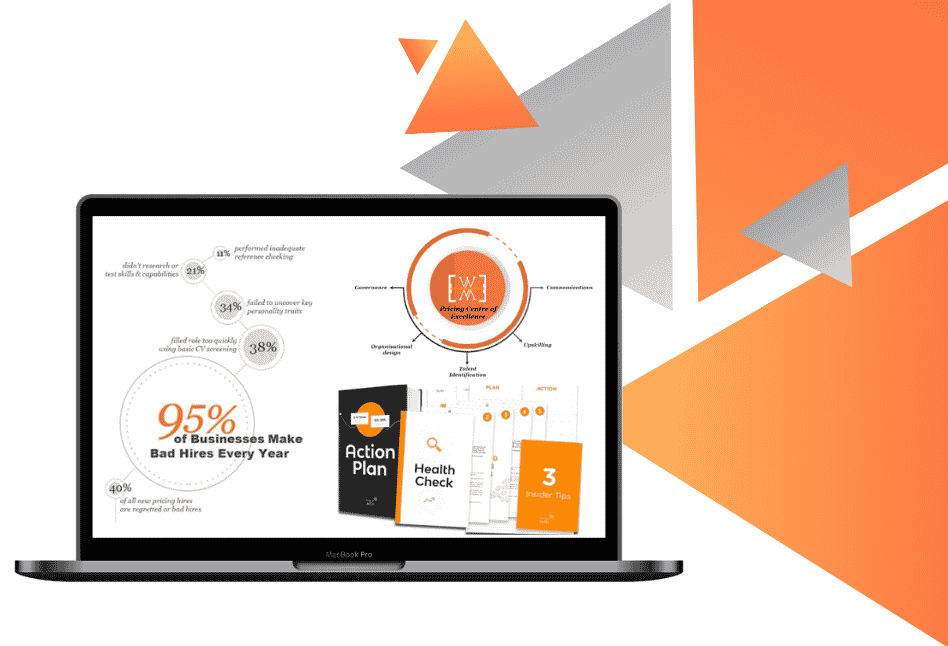

Want Some Extra Fire-Power As You Develop Pricing Strategy With Your Pricing Teams?

Having some deep expertise to call upon just as you and your teams need it is the best way to mitigate risks as you set up your pricing capability project

- Identify the Organisational Structures and Pricing Strategy Framework to drive more revenue and safer margin growth

- Avoid costly consultancy fees and underwhelming results

Download your Executive leadership guide to Commercial Capability Building

THE NUMBER 1 MISTAKE

The biggest mistake CEOs can make is to overestimate the ability of consultants or algorithms to fix pricing and drive commercial strategy. Or, indeed, asking teams to put together tools that frequently do not work well together.

Relying on consultants and algorithms to drive strategy is a quick fix that frequently fails to deliver long-term results.

Asking teams to fix pricing without the requisite resources, capabilities and organisational structures sets them up for failure.

Having targeted advice at critical points in the pricing journey enables teams to bypass painful change processes. Driving commercial strategy three times faster than organic change.

WHAT'S CHANGING

IMMEDIATE RISK TO PROFIT

ADDITIONAL RISKS

The real elephant in the room is siloed culture. When a pricing project is led by IT vendors or strategy consultants, often culture and people problems are not addressed and yet another divisive silo emerges between the team and consultants.

When algorithms are relied upon to drive revenue they often don’t account for the extreme price changes necessary to offset inflation and cover costs.

When businesses rely on pricing systems to set and manage pricing, many vital workflows and processes are left unclear and execution often fails.

As pricing projects start, many cross functional teams are pulled together to work on the project. Many don't know the vision or rationale for change and do not see it as a priority. Others don't know what they are supposed to be doing. It is common for teams, for example, to prioritise low value, day-to-day tasks above mission critical price rise tasks with a deadline.

Working at cross purposes and in siloed businesses costs businesses millions of dollars in lost annual price rise revenue alone.

THE COSTLY ROAD TO RECOVERY

Since 2010, Taylor Wells Advisory firm have worked through 23 pricing transformations. We continue to work with teams to solve some of the most pressing pricing and commercial challenges. Including:

- Companies with no official customer prices or costs for thousands of products.

- Businesses with a legacy list price with hundreds of price inconsistencies.

- Firms that implement a price rise without updating their customer pricing records or contracts.

- Bulk pricing uploads with the wrong customer IDs.

- ERP systems with thousands of redundant pricing records.

- CRMs with rolling rebates and no performance targets or tracking.

- Special prices with no updates and thus never expire.

- No authorisation of customer contract prices.

From our experience, 3-9 percentage points of margin are lost across total revenues when businesses rely on broken consulting models, and as teams work within siloed structures.

Download your Executive leadership guide to Commercial Capability Building

HOW TO ACCELERATE COMMERCIAL AND PRICING STRATEGY FOR LEADERS & PRICING TEAMS

Getting pricing right is challenging for teams when they are managing millions of dollars worth of revenue, complex product portfolios and multiple contract agreements across many different market segments and customer groups. In addition, mistakes are much more costly when market environments are under inflation, competitive moves, fluctuating raw-material prices, and regulatory constraints.

However, it is possible for teams to fast track the journey from start to finish. How? By teaming up with pricing advisors to isolate the exact resources and activities that lead the business to revenue and margin growth.

THE SOLUTION

OUR APPROACH TO DEVELOPING PRICING STRATEGY FOR COMMERCIAL EXECUTIVES & PRICING TEAMS

Connect with our commercial capability building service

THE PROCESS

CASE STUDY ON PRICING STRATEGY FOR PRICING TEAMS

HOW AN ASX INDUSTRIAL BUSINESS WAS ABLE TO GENERATE AN ADDITIONAL 9.5 PER CENT MARGIN IN UNDER 6 MONTHS WITH NEW TARGET PRICING

Taylor Wells started the commercial optimisation process from the top, focusing initially on drafting and planning.

To begin, we supported the executive team to identify key objectives and agreed scope for the roadmap.

We then devised an execution roadmap, including an organisational-wide communications plan to share with the whole business. And set up optimal team and committee structures. These include taskforces, governance and steering committees to oversee and drive multiple projects, deliverables and outcomes.

Then, we devised a system and structure of reviews, checkpoints, meetings, stand-ups, 1-2-1 sessions and feedback loops. This is to ensure capture of all information was captured and there are actions to solve problems.

All meetings had structured agendas with time to debate concepts and discuss project risks, challenges or changes. There were also regular team catch-ups and stand-ups to overcome daily obstacles.

The value of structuring projects like this was that it provided absolute clarity and agreement on direction, purpose and vision from the top down. It gave leaders and their management teams a starting point; a place to forge ahead and forums to steer and guide the projects.

Moreover, it also gave teams the structure they required to avoid working at cross purposes. Everyone knew what they were doing, and why and when. It cut out the red tape. Also, it gave teams a fluid and open system of communicating, capturing learning from multiple tests and trials across numerous workstreams.

The business did not have a strategic pricing function and comprehensive guidelines on how to set up and integrate a pricing function. This is needs the attention of every business.

Our first step in the integration process was designing and building optimal team structure and team roles.

Next, is the utilisation of our pricing recruitment service to help the business appoint a high calibre pricing manager.

The commercial requirements of the business needed a pricing manager with a special mix of skills, capability and potential. Hence, we employed our unique pricing manager assessment framework, datasets and talent pools.

Our Pricing Manager Assessment framework was the basis upon which executives in this business made their selection decision for this appointment.

Within 1 month we found a high-performing pricing manager with the capabilities we needed. The pricing manager has since been promoted in the business and the pricing function is a highly regarded and growing function.

From week 1 of the pricing manager joining the business, we began a structured onboarding process.

The onboarding had two main objectives. The first is to align pricing to commercial strategy according to the Pricing Roadmap. While the other is to deliver $1.5M in EBIT by the end of the year with incremental margin growth present from at least month 3 of the roadmap.

With these objectives and targets in mind, we designed an onboarding programme and workflows to deliver results in the first 3 months, 6, 9 and 12 months.

We developed customised pricing plans to support the pricing manager build a strategic price architecture.

Then, we co-created and developed strategies and analytics using a range of methods – value-based pricing, competitive pricing, attribute-based pricing to optimise revenues and prices.

We developed pricing communication plans, stakeholder engagement initiatives and then technical ERP price structure designs for a new ERP system.

To accelerate the implementation of these plans, we designed a system of structured coaching and communication.

All plans were actioned, implemented and delivered the required EBIT results.

When we were sure our pricing plans were capturing value, we initiated the next plans. These include plans for the sales and category management teams to bolster the results we were getting from the pricing project.

We built customised plans and workflows and aligned plans and workflows to the new pricing roadmap, strategy and mission.

All team interdependencies were mapped out. Every task was identified, prioritised and categorised within workstreams. Also, all workstreams and projects were given project owners and sponsors.

There were regular steering committee meetings that we helped to facilitate. Besides that, there were also frequent stakeholder and project meetings set up to ensure delivery from the line managers’ teams.

All of these meetings were all project managed and aligned to the roadmap and tracked using dashboards. What’s more, all ideas and actions were captured and given to owners.

Once team plans were designed and issued, the next step was to do a series of experiments. These include structured tests and trials to project stakeholders in sales, HR, category, marketing, IT, executive team, procurement, and finance.

Structured learning in this requirement was underpinned by testing, scientific investigation and subject matter expertise. If there were gaps in knowledge, they were filled in a timely manner. This is accompanied with targeted coaching to ensure delivery and decision-making were effective and speedy.

Taking the pricing manager function as an example. We worked with the new pricing manager to test if target pricing could be applied to uncontracted revenue. Then, we set up a trial. This is by combing through 21,ooo lines of data and establishing via testing new target pricing for over 6,000 individual line items.

Within 4 months, the business was generating an additional 9.5 per cent margin on the newly priced items. Within 6 months, new and proven pricing processes were documented and embedded in the business. All tasks, decisions and workflows were set up.

Many of the tests and trials set up during this time were ideas from the team as well as us.

This new way of capturing ideas and then turning them into real $ value brought about a cross-functional way of optimising sales, product innovation and pricing that was not dependent on us or any one person in the business.

What’s more, the new system highlighted all the great work the teams were doing. Teams were finally recognised for their positive contributions to margin generation, as the business finally had visibility of all the workflows, ideas and value capture being achieved on a daily basis.

Commercial optimisation is a continuous process. It involves all departments, not just pricing. Take HR, for example:

Do HR recruit and train people that are really in line with the business or its pricing strategy?

Are commercial teams incentivised, rewarded and recognised? In what way? Does it truly motivate people with unique pricing skills to deliver more complex business outcomes?

Are the pricing and sales teams set up properly to implement the commercial strategy – tool kits, training, resourcing?

If the answer is no across the board, unsuitable people are being employed. Training is less than effective. Salary, reward and talent management structures are driving talent away. Great sales teams are missing out on sales through no fault of their own.